DJI Loses Big Share of Commercial Drone Market, DroneAnalyst Report Finds

BY Zacc Dukowitz

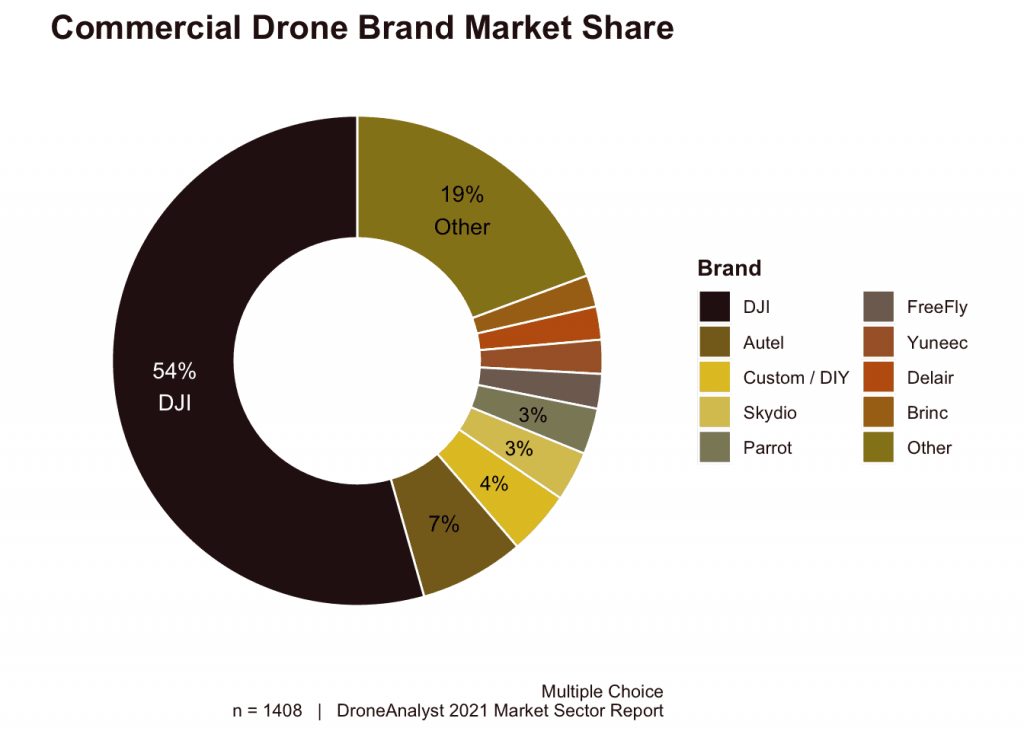

22 September 2021According to DroneAnalyst’s 2021 Drone Market Sector Report, DJI’s share of the commercial drone market has dropped 15% over the last year, from 69% in 2020 to 54% in 2021.

Image source: DroneAnalyst

DroneAnalyst attributes the decline to several factors, including:

- Diminished staff size at DJI

- DJI’s cancellation of events like AirWorks

- Stiffer competition

- DJI’s addition to the U.S. Department of Commerce’s Entity List

Although 15% is a big drop, the numbers show that DJI still dominates commercial drone sales.

As you can see in the pie chart above, no other drone manufacturer comes anywhere close to the 54% majority share DJI holds in the market—Autel, the second company after DJI, only holds 7%, while Skydio and Parrot respectively have 4% and 3%.

Here are all the top players in the commercial drone market, according to the report:

- DJI—54%

- Other / Custom / DIY—23%

- Autel—7%

- Skydio—4%

- Parrot—3%

- Freefly*

- Yuneec*

- Delair*

- Brinc*

*DroneAnalyst did not share specific percentages for these companies.

Image credit: DJI

Wondering about the consumer drone market?

Although DJI lost a big part of the commercial drone market, on the consumer side DJI’s dominance hasn’t shifted at all—the report shows the company maintaining an incredible 94% of the consumer drone market.

Wondering where the data came from? This year, DroneAnalyst’s Market Sector Report drew responses from 1,800 people located in 110 countries, who work in 39 different industries. The report also drew from a series of qualitative interviews.

Are Privacy Concerns Hurting DJI’s Bottom Line?

It would be easy to say that rumors of a forthcoming Chinese drone ban driven by fears that Chinese drones are being used to spy on the U.S. have been driving commercial clients away from Chinese companies—and from DJI specifically.

Image credit: DJI

This explanation is the last one of the four DroneAnalyst floated in a blog post highlighting the findings from its 2021 report—that is, that DJI’s addition to the U.S. Department of Commerce’s Entity List contributed to its loss of market share.

But pointing to only that one item—being added to the Entity List—vastly oversimplifies the nexus of privacy concerns and country-of-origin ban discussions that have plagued DJI over the last several years.

[Related read: Want to Make Sure Your DJI Drone Isn’t Sharing Your Data? Here’s What to Do]

Starting as far back as 2017, when the U.S. Army banned all use of DJI drones, the company has faced accusations around concerns that it is covertly collecting and sharing user data.

Whether there is truth to these allegations has never been made completely clear—despite all the chatter, a leaked Pentagon report in June of this year found that two DJI drones had been cleared for government use.

But the accusations have been used successfully to push a protectionist agenda for the drone industry in the U.S., with legislation drafted that proposes a blanket ban on governmental use of drones from China (and other countries), as well as big infusions of cash into U.S. drone companies to help them become established and competitive with DJI.

In fact, the conversation seems to have shifted lately, with a focus not so much on privacy but on whether a drone is “Made in USA”—so much so that the FTC recently issued a rule cracking down on companies who falsely make the claim. (The rule wasn’t just for drone companies, but drone companies have certainly been guilty of touting the claim while their supply chain continues to rely on foreign drone components.)

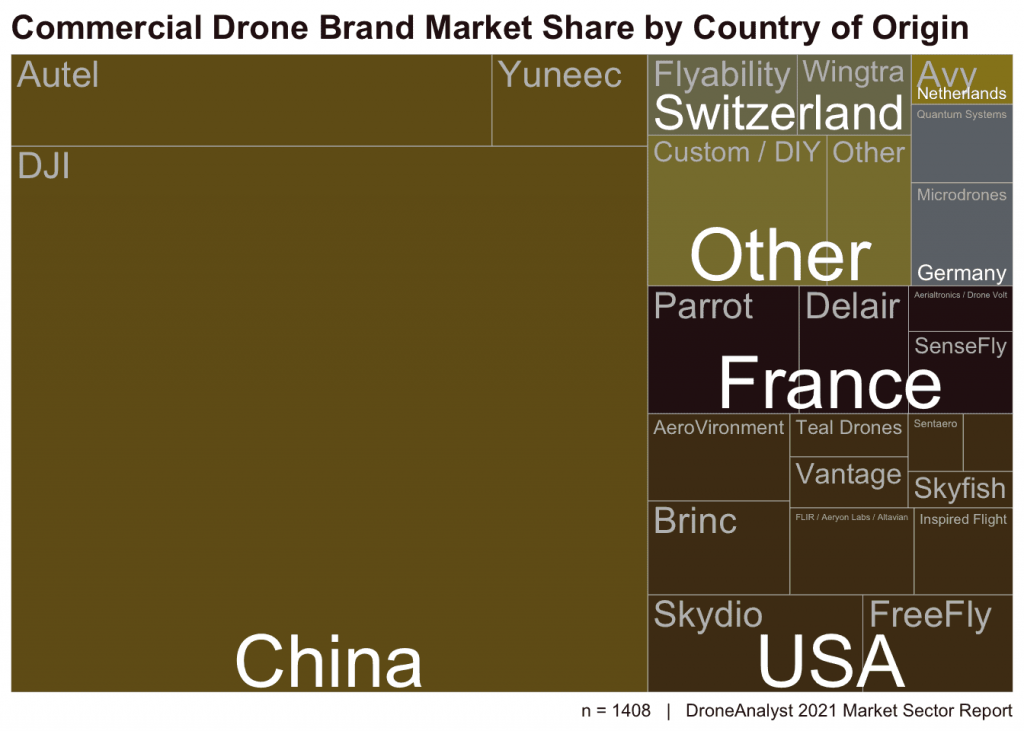

And yet despite all of these efforts, Chinese drone companies still dominate both the commercial and the consumer drone markets. Check out this image DroneAnalyst made representing commercial drone market share based on the countries in which each drone company is based to see what we mean:

Image source: DroneAnalyst

Maybe the biggest surprise in DroneAnalyst’s data is that the five Blue UAS companies—those drone companies with platforms deemed safe for government use by the Department of Defense and the Pentagon—aren’t doing better in the commercial sector.

Those companies are Skydio, Teal Drones, Parrot, Vantage Robotics, and Atlavian.

Despite being valued at a billion dollars this year, Skydio holds only 3% of the commercial drone market. Atlavian didn’t even make the list, and both Teal Drones and Vantage Robotics had such small shares of the market that they seem to have been included in the “Other” category.

Finally, Parrot’s share of the commercial drone market actually dipped from 2020 to 2021.

The Rise of Diversity and Niche Applications

If privacy concerns were a big driver in DJI’s loss of market share, you’d expect to see a corresponding rise in market share among these five companies. But the data doesn’t seem to support this connection—at least not as a single explanation for where DJI’s market share may have gone.

DroneAnalyst’s data actually paints a much more complicated picture.

Yes, privacy concerns and protectionism have definitely contributed to DJI’s loss of market share. But the commercial drone market itself is changing, as evidenced by the huge amount of market share held by those in the “Other” category, as well as those in the “Custom/DIY” category.

Photo credit: Brinc Drones

In fact, many drone manufacturers selling into the commercial sector don’t seem to see themselves as competing with DJI at all.

Take Matt Sloane for example—he’s the CEO of SkyFire Consulting, an Atlanta-based UAS consulting group that works with public safety agencies throughout the U.S.

Last year, SkyFire acquired a small U.S. drone manufacturing company called Viking UAS. When we interviewed him at the time to get his take on proposed “Chinese drone ban” legislation, he said that he wasn’t interested in taking on DJI or replacing them.

His company provides drones built on spec for individual public safety agencies. Since this is something DJI doesn’t offer, DJI isn’t a concern for his core business.

Photo credit: Flyability

A similar focus on niche solutions can be seen across the drone industry.

Flyability makes the Elios 2, a caged drone created just for inspections in confined spaces, while Brinc Drones—a newer company we were surprised to see make DroneAnalyst’s list of the top companies with a share of the commercial market—makes the Lemur, a drone just for public safety applications.

As the drone industry matures, DJI could continue to lose commercial market share because it may just not have the very best, most customized solution for the manifold niche applications that are arising. And all the smaller, niche-focused companies like SkyFire Consulting, Brinc Drones, and Flyability, as well as newer companies that we haven’t even heard of yet, may be the ones to snap up that share of the commercial market.

By the same reasoning, DJI may never lose its dominance in the consumer market, since consumer needs aren’t likely to change or grow more focused on niche applications as the years go by.